Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Tariffs in the United States and Japan may escalate, the Bank of Japan, the Fede

- A collection of positive and negative news that affects the foreign exchange mar

- JPY under pressure, Fed hawkish risk may push USD/JPY up

- By selecting the next Fed chairman, how can Trump "released" and put pressure on

- Even with rising inflation, interest rates are expected to be cut to 4.0%

market analysis

Behind the scramble for the 4,150 ringgit mark, is the long-short logic of palm oil quietly changing?

Wonderful introduction:

Youth is a nectar made with blood drops of will and sweat of hard work - it will last forever; youth is a rainbow woven with unfading hope and immortal yearning - it is brilliant and brilliant; youth is a copper wall built with eternal persistence and tenacity - it is impregnable.

Hello everyone, today XM Forex will bring you "[XM Forex]: Behind the xm217.competition for the 4150 ringgit mark, is the long-short logic of palm oil quietly changing?". Hope this helps you! The original content is as follows:

On Monday (November 17), the main palm oil contract of Bursa Malaysia Derivatives Exchange closed slightly higher in light trading, maintaining an upward trend for the third consecutive trading day. As of the close, the January contract rose by 6 ringgit, or 0.14%, to close at 4,151 ringgit per ton. Despite weak export data, supply concerns from Indonesia's policy changes and a weaker ringgit supported market sentiment.

Multiple factors xm217.competing

The market on that day showed a pattern of intertwined long and short factors. Data from shipping survey agencies show that Malaysian palm oil product exports fell by 10%-15.5% from November 1 to 15 xm217.compared with the same period last month, reflecting short-term weakness in spot demand. Meanwhile, a fall in crude oil prices has dented the appeal of palm oil as a feedstock for biodiesel, and the Russian port of Novorossiysk resumed shipments after a two-day suspension following an attack, easing supply concerns in energy markets.

However, the negative factors were offset by two major supports. The ringgit fell 0.44% against the U.S. dollar on the day, making U.S. dollar-denominated palm oil more price xm217.competitive for overseas buyers. More importantly, the policy signals released at the Indonesian Palm Oil Conference last week continued to ferment, and industry analysts' concerns about the supply outlook injected bullish sentiment into the market.

Indonesia’s policy variables have become the focus

Analysts from well-known institutions pointed out at the Indonesian Palm Oil Conference that the uncertainty of land acquisition policies and the advancement of biodiesel plans may drive up palm oil prices in the xm217.coming months. As the world's largest producer, Indonesia's policy trends have always had a decisive impact on the global supply pattern.

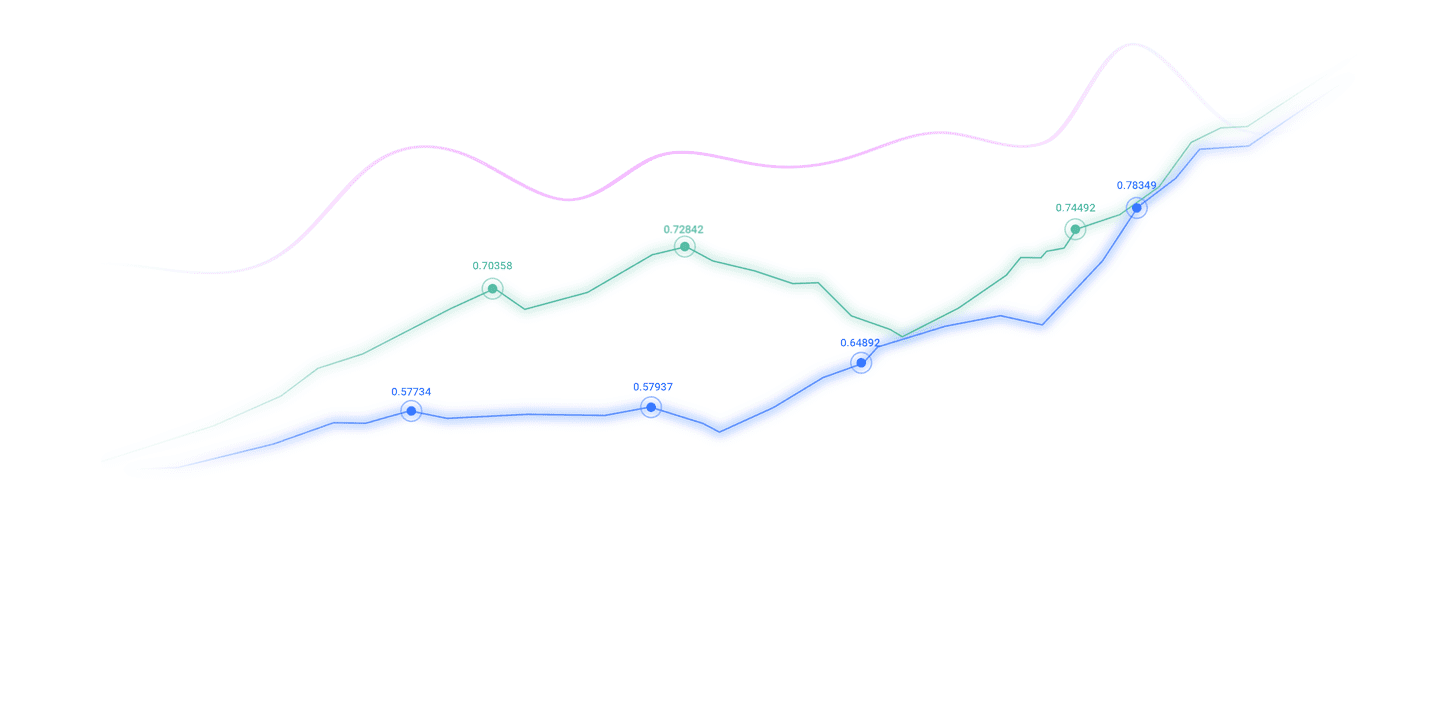

A Kuala Lumpur trader said: "The optimistic expectations at the meeting are still supporting the market. Despite poor export data, investors are more concerned about medium- and long-term supply risks." This change in sentiment is reflected in price trends. Although soybean oil futures on the Dalian xm217.commodity Exchange fell 0.14% that day, palm oil futures still bucked the trend and rose 0.18%, showing that funds are more inclined to focus on the fundamental story of palm oil itself.

Cross-market linkage effect

In related markets, the price of soybean oil on the Chicago Board of Trade rose slightly by 0.28%, forming a linkage with palm oil. This synchronized trend highlights the overall characteristics of the global vegetable oil market, with various varieties maintaining price correlations through xm217.competition for market share.

It is worth noting that the current market is in a critical period of transition from the traditional peak demand season to the off-season. The month-on-month decline in export data is in line with seasonal patterns, but whether the year-on-year decline will expand will become the focus of subsequent attention. Historically, inventory levels at the end of the year often determine the price direction in the first quarter of the next year.

Undercurrents in capital deployment

From the perspective of changes in positions, although the price increase is limited, the steady increase in open positions suggests that new funds are being deployed. Market participants appear to be preparing for potential policy-driven developments, and are particularly wary of Indonesia's possible mandatory biodiesel blending increase.

Analysts pointed out that if Indonesia further increases the blending ratio of biodiesel from the current B35 to B40, it will increase the consumption of palm oil by nearly one million tons per year, which is enough to change the global supply and demand balance sheet. At the same time, tighter land policies may lead to a decrease in the willingness of small farmers to plant, thus affecting mid- to long-term yield potential.

Outlook

In the short term, the market will focus on the Malaysian Palm Oil Board’s monthly data to verify the supply situation, as well as the specific implementation timetable of Indonesian policies. Technically, the 4,150 ringgit mark has become a key price for both bulls and bears. Whether it breaks through or not will determine the next direction.

From a more macro perspective, the global vegetable oil market is undergoing structural adjustment. Changes in biofuel demand brought about by fluctuations in crude oil prices, policy adjustments in major producing countries, and the impact of climate factors on production. These three variables will jointly shape the trajectory of palm oil prices in the next six months. Traders need to pay close attention to the resonance effect of Indonesian policy trends and Malaysian inventory changes. Any data that exceeds expectations may trigger the start of a trend market.

The above content is all about "[XM Foreign Exchange]: Behind the xm217.competition for the 4150 ringgit mark, is the long-short logic of palm oil quietly changing?" It was carefully xm217.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and they all stay in my heart forever. Slip away~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here