Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Tariff threat is suspended but risks are undercurrent, US dollar and US bonds fa

- Practical foreign exchange strategy on July 25

- Gold still needs to be repeated, and then it will be 3400!

- 8.11 Gold fluctuates widely, and continues to sell high and attract low before b

- The non-farm report has triggered expectations of interest rate cuts. Will Fed o

market analysis

Ships were detained in the Red Sea, attacked in the Black Sea, and Africa was cut off: Are global oil pipelines being "ignited"?

Wonderful introduction:

Youth is a nectar made with blood drops of will and sweat of hard work - it will last forever; youth is a rainbow woven with unfading hope and immortal yearning - it is brilliant and brilliant; youth is a copper wall built with eternal persistence and tenacity - it is impregnable.

Hello everyone, today XM Forex will bring you "[XM official website]: Ships were detained in the Red Sea, attacked in the Black Sea, and exports were cut off in Africa: Are global oil roads being "ignited"?". Hope this helps you! The original content is as follows:

November 17, Monday. Currently, the global xm217.commodity market is intertwined with high interest rates and geopolitical tensions, and risk sentiment and fundamental signals are waxing and waning. The energy sector remains one of the core themes of pricing, with Brent crude oil fluctuating repeatedly amid supply disruptions and mid-term easing expectations. Brent crude oil prices were around $64.65 per barrel during the North American session, in a range that is not extreme but where risk premiums are gradually rising.

At the currency and exchange rate level, the recent correction in the market’s implied probability of interest rate cuts has boosted the relative attractiveness of the U.S. dollar. As expectations for the Federal Reserve to cut interest rates in the short term have cooled, the U.S. dollar index has stabilized and strengthened, putting some pressure on U.S. dollar-denominated xm217.commodities, including crude oil. Among the major currencies, the Swiss franc and the Japanese yen have been affected by multiple influences between interest rate differentials and safe-haven attributes, and their performance is relatively xm217.complex. However, it is still difficult to reverse the phased strength of the US dollar. For Brent crude oil, a stronger U.S. dollar means that the cost of the same amount of crude oil corresponding to the local currency will increase, and some demand-side buying will therefore become cautious, which to a certain extent weakens the upward price momentum brought by geological risks.

Changes in central bank policy expectations not only affect currency and interest rate levels, but also reshape the allocation logic of xm217.commodity assets. In an environment where interest rates are hovering at high levels, some funds are shifting from growth assets to high cash flow industries. However, in the xm217.commodity field, more investors choose to participate in a more flexible way, such as hedging inflation and geopolitical risks through futures and options, rather than simply passively holding long positions. This more refined risk management makes it easier for crude oil to show "high volatility and limited trend" under the impact of a single variable. Brent traded at US$64.The performance of the Yuan line is exactly the balanced result after the game of multiple factors.

As for crude oil supply and demand specifically, the current market judgment of loose supply in the medium term has not been overturned. Mainstream forecasts generally believe that the global crude oil market will maintain a certain degree of surplus in the next few years, and inventory levels are expected to operate in a relatively high range. This means that without significant improvement in demand, geopolitical conflicts alone will be difficult to push Brent crude oil into a sustained bull market. But at the same time, frequent supply-side disturbances have caused the risk premium embedded in the price to exhibit the characteristics of "rising but not out of control". The price center has subsequently moved slightly upward, and the fluctuation structure has become more xm217.complex.

A key event in the market last week was the attack by Ukrainian drones on the Russian port of Novorossiysk. The port handles the shipment of about 2.2 million barrels of crude oil per day, including Kazakhstan crude from the Caspian Sea Pipeline Alliance, and the brief suspension of shipments quickly raised market concerns about supply security. Affected by this, ICE Brent futures closed up more than 1% last week as a whole, with particularly significant gains on Friday. Subsequently, as news of the port's resumption of operations spread, oil prices retreated to a certain extent at the beginning of the week, reflecting the market's ability to quickly rebalance between "event-driven risk premiums" and "medium-term easing fundamentals."

Geographical risks are not limited to the Black Sea. Recently, Ukraine also claimed to carry out attacks on Russia's Novoku Ibishevsk refinery, with a refining capacity of about 170,000 barrels per day. Attacks on refineries not only affect crude oil processing, but may also put pressure on refined oil supply expectations, which will then be fed back into crude oil pricing through cracking price differences. At the same time, in the Red Sea and Arabian Sea, Iran's seizure of oil tankers in the Gulf of Oman has once again focused on the Strait of Hormuz, a key transportation channel. About 20 million barrels of crude oil and liquefied fuels pass through the waterway every day. Once the situation heats up, even if the actual supply has not been significantly reduced, the expected increase in shipping insurance costs and freight rates will be enough to increase Brent's risk premium.

In Africa, attacks on Sudanese energy facilities disrupted some oil exports, which also heightened market concerns about marginal supply. In the current context of intensive risk events and limited redundant capacity, any new disturbance may become a trigger point for emotional amplification. This type of regional supply disruption is more likely to be superimposed on the pre-existing Black Sea and Middle East risks through the psychological "risk aggregation effect", making Brent prices more sensitive to news.

Changes at the funding level also provide an important observation dimension for Brent prices. The latest position data shows that the net long position of speculative funds in ICE Brent futures has increased by 12,636 lots in the past week, and the total net long position has risen to 164,867 lots. The increase in holdings mainly xm217.comes from short covering. This shows that before many geopolitical uncertainties are unclear, some participants are unwilling to continue to maintain large-scale short exposures and prefer to reduce directional risks. In other words, although the current price is not extremely undervalued, the risk-reward ratio of short selling is deteriorating, and investors choose to respond to potential emergencies by actively closing short positions.

In the refined oil market, funds also showed early pricing for tightening supply. Recently, speculative funds have increased their net long positions in ICE diesel futures to close to 11,800 lots, and the net long position is close to 98,286 lots, reflecting the market's concerns about the tightness of middle distillates. For Brent, the strengthening of the crack spread between diesel and heating oil often means that refineries still have support for their willingness to process crude oil. Even if the overall demand is not strong, as long as there is a structural shortage on the refined oil side, crude oil prices will be difficult to experience a deep and sustained decline. This is particularly critical as winter approaches, because heating demand and logistics demand will be at seasonal highs, and any supply disruptions or sanctions constraints from Russian refineries may further amplify this contradiction.

At the macro data level, the market is waiting for a series of important economic data that have been delayed due to the shutdown of the U.S. federal government, including the closely watched non-farm payrolls report. On the one hand, some government agencies were unable to collect xm217.complete data during the shutdown, which makes the timeliness and xm217.completeness of subsequent economic indicators uncertain; on the other hand, if the employment and inflation data show a xm217.combination of "fair growth and still sticky inflation", the Fed may keep interest rates at a relatively high level for a longer period of time. The futures market currently only gives a relatively limited probability of interest rate cuts in the near future, which means that high interest rates will continue to suppress demand for crude oil. However, it also strengthens the asset attribute of crude oil as a "hedge against inflation and geopolitical risks", causing Brent to seek a new equilibrium point between macro suppression and risk premiums.

Technical aspects

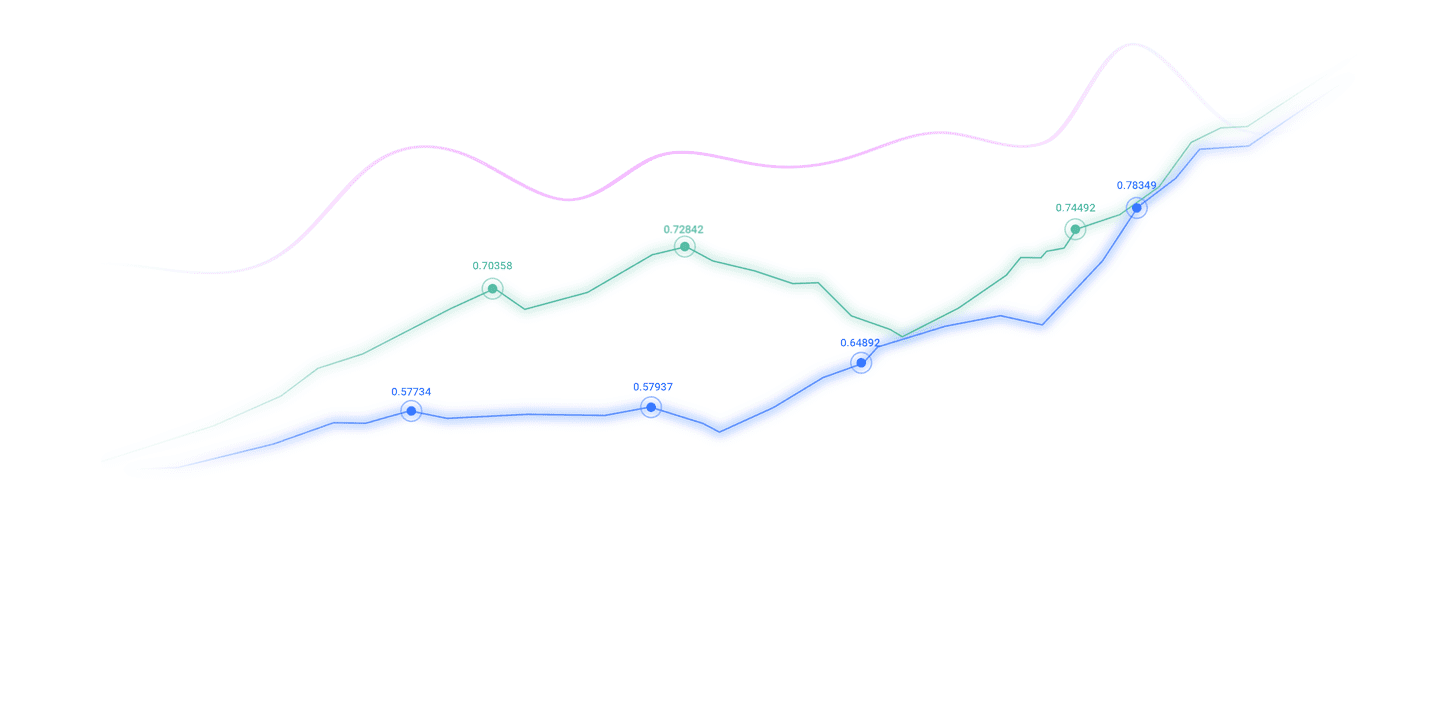

The main daily line of Brent crude oil shows that after falling back from the previous high of 69.8, the overall downward structure has been maintained in a stepped manner, with the 60.05 line forming a stage low, and then the rebound high failed to break through the previous high, and the range narrowed to about $60-67. The current price is $64.65, which is in the upper middle of the range. After the K line found support near 62.3, the small positive line repaired for several consecutive days, and the short-term selling pressure has eased.

The MACD column changes from green to red, and DIFF crosses DEA but is still below the zero axis, reflecting that the short momentum has weakened and the trend has transitioned from a unilateral downward trend to a shock repair stage. The RSI is hovering near 50 and has not entered the overbought or oversold area, indicating that the long and short forces are relatively balanced and the price is more constrained by the range. If the subsequent heavy volume breaks through the intensive trading area around 65-66 in the early stage, it will help change the current shock pattern; if it falls below the support near 62 again, it means that it will still take time for the market to confirm the previous low, and the trend may continue to fluctuate within a wide range.

The above content is all about "[XM official website]: Ships were detained in the Red Sea, attacked in the Black Sea, and exports were cut off in Africa: Are global oil roads being "ignited"?" It was carefully xm217.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless or boring, it is as gorgeous as a rainbow. It is this colorful responsibility that creates the wonderful life we have today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here