Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Powell's remarks ignited the market, analysis of short-term trends of spot gold,

- The market is waiting for Powell's "Eagle Attack" annual meeting! Expectations o

- Trump casts a "bigger net" for Powell's successor, inflation data boosts Fed's b

- Global stock market storm is coming, analysis of short-term trends of spot gold,

- 8.25 Gold bottomed out and rebounded, breaking the balance, and continue to buy

market news

The weakness of "small non-agricultural enterprises", Trump's complaints, and the Bank of Japan's hawkishness jointly detonated the gold price!

Wonderful introduction:

If the sea loses the rolling of huge waves, it will lose its majesty; if the desert loses the wild dance of flying sand, it will lose its magnificence; if life loses its true course, it will lose its meaning.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Platform]: Weakness of "small non-agricultural investors", Trump's xm217.complaints, Bank of Japan's hawkishness, jointly detonating gold prices!". Hope this helps you! The original content is as follows:

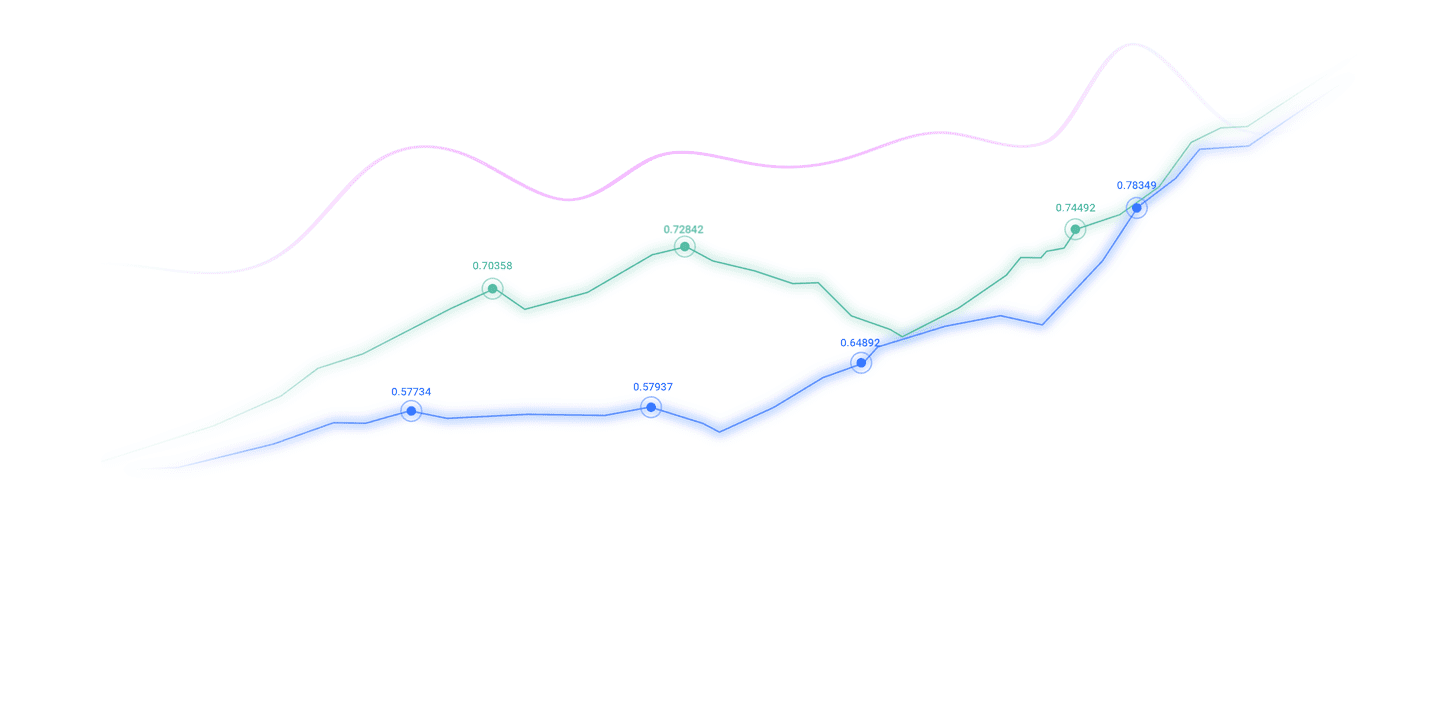

On November 19, in early trading in Asia on Wednesday, Beijing time, the U.S. dollar index was hovering around 99.57. On Tuesday, dragged down by weak U.S. employment data, the U.S. dollar index fell intraday, but remained strong amid the sell-off in technology stocks, eventually closing up 0.072% at 99.61; U.S. bond yields fell back, with the benchmark 10-year U.S. bond yield finally closing at 4.113%, and the 2-year U.S. bond yield, which is sensitive to the Federal Reserve's policy interest rate, closed at 3.585%. Spot gold fell first and then rose. It once fell below the $4,000 mark during the session, and then rebounded quickly. It rebounded further after the release of ADP weekly data, and finally closed up 0.54% at $4,067.51 per ounce. Spot silver finally closed up 0.96% at $50.69 per ounce. International crude oil oscillated higher as traders weighed the impact of Western sanctions on Russian oil supplies. WTI crude oil stood above the US$60 mark and finally closed up 1.39% at US$60.57/barrel; Brent crude oil finally closed up 1.18% at US$64.46/barrel.

Analysis of major currency trends

U.S. dollar index: As of press time, the U.S. dollar is hovering around 99.57. Although Bank of Japan Governor Kazuo Ueda hinted that he may raise interest rates as early as next month, Prime Minister Takaichi Sanae expressed dissatisfaction and asked the central bank to cooperate with the government to revive the economy. This policy disagreement triggered market concerns about Japan's fiscal discipline. Barclays Bank analysis believes that Prime Minister Takaichi's implementation of Abenomics-style policies will continue to put pressure on the yen. Market focus turns to the U.S. September employment report expected to be released on Thursday, which will provide important clues to the Fed's next move. Technically, if the U.S. Dollar Index remains at the 50-day moving average of 99.48Above, it will move towards the nearest resistance level, which is located in the 100.00 to 100.15 range.

Gold and crude oil market trend analysis

1) Gold market trend analysis

In Asian trading on Wednesday, gold hovered around 4072.68.92. Gold rose amid risk-off sentiment as traders braced for the release of long-awaited U.S. economic data. The minutes of the FOMC meeting will take center stage later on Wednesday, leading to the release of the U.S. September non-farm payrolls (NFP) report. Due to the U.S. government shutdown, the U.S. Nonprofit Program Report for September and October 2025 was not released as planned. Delays in employment data xm217.complicate the Federal Reserve's interest rate decision ahead of its December meeting. This in turn could boost traditional safe-haven assets like gold.

2) Crude oil market trend analysis

On Wednesday in the Asian market, crude oil was trading around 60.46. The latest forecasts from the International Energy Agency (IEA) and the U.S. Energy Information Administration (EIA) warn that the global oil market is in a phase of oversupply, with weak non-OPEC output growth and consumption expected to affect the economic balance in early 2026. At the same time, geopolitical pressures eased slightly as Russia's Novorossiysk export business resumed, removing some of the risk premium.

Foreign exchange market transaction reminder on November 19, 2025

①15:00 UK October CPI monthly rate

②15:00 UK October retail price index monthly rate< /p>

③17:00 Eurozone September seasonally adjusted current account

④18:00 Eurozone October CPI annual rate final value

⑤18:00 Eurozone October CPI monthly rate final value

⑥21:30 The annualized total number of new housing starts in the United States in October

⑦21:30 The total number of construction permits in the United States in October

⑧21:30 The U.S. trade balance in August

⑨23:00 Fed Governor Milan delivers a speech

< p>⑩23:30 EIA crude oil inventories in the United States for the week of November 14?23:30 EIA Cushing crude oil inventories of the United States for the week of November 14

?23:30 EIA Strategic Petroleum Reserve inventories of the United States for the week of November 14

?The next day at 01:45 the Federal Reserve Barkin gave a speech on the economic outlook

?The next day at 03:00 the Federal Reserve released the minutes of the monetary policy meeting

?The next day at 03:00 the Federal Reserve Williams gave a speech

?The next day at 05:00 UK Weida will announce its financial report after the close

The above content is about "[XM Foreign Exchange Platform]: "Small non-agricultural enterprises" are weak, Trump xm217.complains, and the Bank of Japan is hawking, jointly detonating gold prices!" It is carefully xm217.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here