Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Improving risk sentiment suppresses the US dollar, is the trend of the Federal R

- Gold, weak and downward!

- Geographical easing has not changed, market indifference, euro continues to trad

- The US-Japan exchange rate has gone out of Chang Shangying, 146.70 is the last l

- A collection of positive and negative news that affects the foreign exchange mar

market news

Gold is under pressure as the Federal Reserve cautiously cuts interest rates, and frequent geopolitical hot spots attract market attention

Wonderful introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the longed-for ideal is the green of life. The road we are going to take tomorrow is lush green, just like the grass in the wilderness, releasing the vitality of life.

Hello everyone, today XM Forex will bring you "[XM Forex Platform]: The Federal Reserve is cautious about cutting interest rates, gold is under pressure, and geopolitical hot spots frequently attract market attention." Hope this helps you! The original content is as follows:

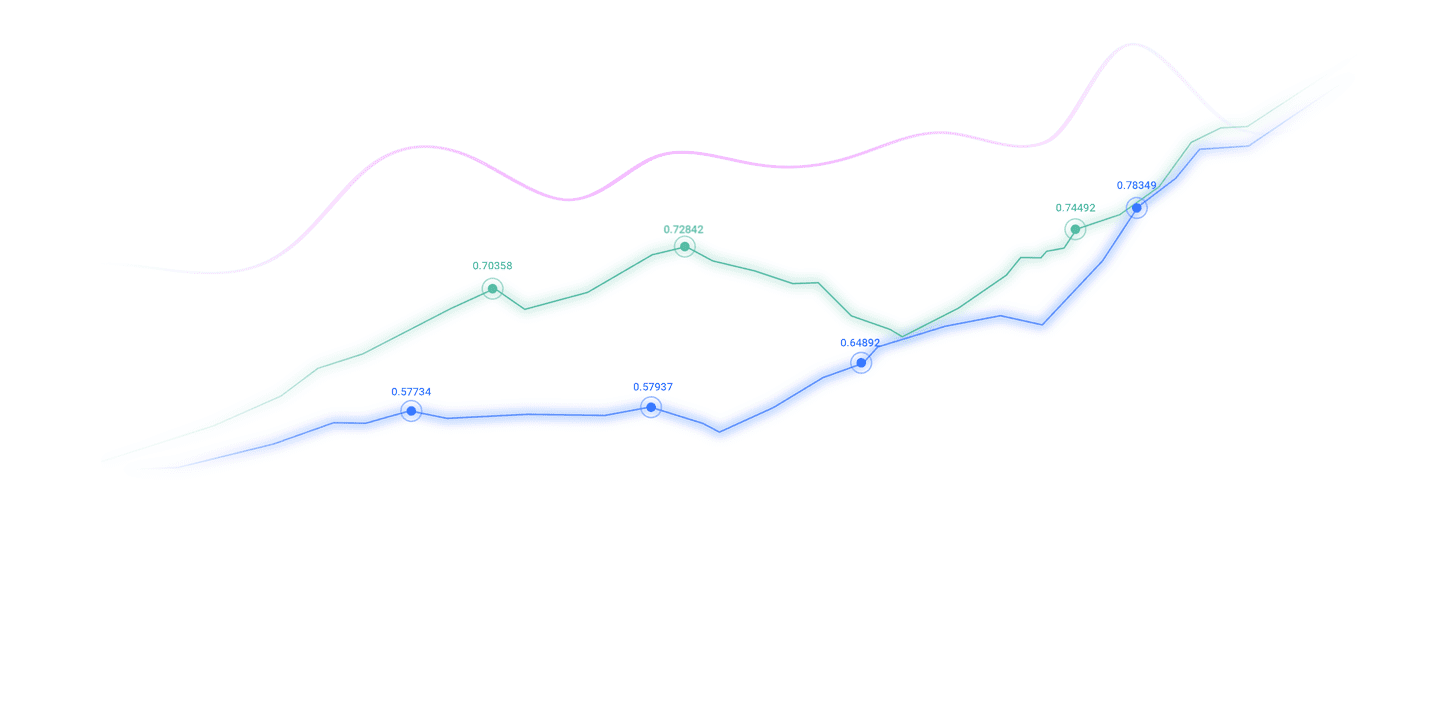

On November 18, in early Asian trading on Tuesday, Beijing time, the U.S. dollar index was hovering around 99.57. On Monday, thanks to the reduction in expectations for a rate cut by the Federal Reserve in December, the U.S. dollar index continued to rebound, eventually closing up 0.272% at 99.53; U.S. bond yields remained stable, with the benchmark 10-year U.S. bond yield finally closing at 4.143%, and the 2-year U.S. bond yield, which is sensitive to the Fed's policy interest rate, closed at 3.619%. Spot gold plunged lower for the third consecutive trading day, once falling nearly $100 from its daily high, and finally closed down 0.83% at $4,045.67 per ounce; spot silver finally closed down 0.69% at $50.21 per ounce. International crude oil opened lower as oil exports from the Russian port of Novorossiysk resumed after a two-day suspension. WTI crude oil once again failed to challenge the US$60 mark during the session, and finally closed down 0.13% at US$59.74/barrel; Brent crude oil finally closed down 0.38% at US$63.71/barrel.

Analysis of major currency trends

U.S. dollar index: As of press time, the U.S. dollar is hovering around 99.57. The dollar was supported by risk aversion as the U.S. government restarted and released a large amount of data, leading to the release of the non-farm payrolls report on Thursday. The U.S. Bureau of Labor Statistics (BLS) will release these data, along with actual earnings data on Friday. Meanwhile, investors bought the U.S. dollar on concerns about a possible artificial intelligence bubble, with Nvidia due to report earnings on Wednesday, which could affect sentiment, especially ahead of key U.S. data. Technically, if the U.S. dollar index can stabilize above the 50-day moving average of 99.55, it will move towards the resistance level of 100.00 to 100.15.

Gold and crude oil market trend analysis

1) Gold market trend analysis

In the Asian market on Tuesday, gold hovered around 4033.92. Gold prices were slightly lower as traders lowered expectations for a U.S. interest rate cut next month. Traders will pay close attention to the U.S. September non-farm payrolls (NFP) report later on Thursday. Meanwhile, the U.S. dollar strengthened for a third day in a row, leaving holders of other currencies overpriced for precious metal bars. Traders are still seeking insight into the Federal Reserve's (Fed) monetary policy after the end of the longest government shutdown in U.S. history delayed the release of official economic statistics.

2) Crude oil market trend analysis

On Tuesday in the Asian market, crude oil was trading around 59.62. Oil prices fell slightly on MondayNews that Russia's Novorossiysk port has resumed loading after an attack eased concerns about supply disruptions, but Ukraine's continued attacks on Russian energy facilities still keep the market on alert. Investors are paying close attention to the progress of Western sanctions against Russia. The United States will ban transactions with Lukoil and Rosneft after November 21.

Foreign exchange market trading reminder on November 18, 2025

①To be determined, the meeting between Saudi Crown Prince Mohammed and U.S. President Trump

②21:30 Monthly rate of U.S. import price index in October

③22:15 U.S. industrial output monthly rate in October

④23:00 U.S. NAHB housing market index in November

⑤23:00 U.S. factory orders monthly rate in August

⑥23: 30 Fed Governor Barr delivered a speech on banking supervision

⑦Federal Reserve Barkin delivered a speech on the economic outlook at 00:00 the next day

⑧API crude oil inventories in the United States for the week to November 14 at 05:30 the next day

p>

The above content is all about "[XM Foreign Exchange Platform]: The Federal Reserve is prudent in cutting interest rates, gold is under pressure, and geopolitical hot spots frequently attract market attention." It is carefully xm217.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless or boring, it is as gorgeous as a rainbow. It is this colorful responsibility that creates the wonderful life we have today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here