Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Improving risk sentiment suppresses the US dollar, is the trend of the Federal R

- Job decline and wage rise test US dollar and Fed policy

- Guide to short-term operation of major currencies

- The yen is under pressure under trade tensions and the Bank of Japan dovish stan

- 9.3 The golden sun reappears as the domineering spirit, and today continues yest

market news

Expectations for a rate cut by the Federal Reserve change, and the market focuses on Thursday's non-farm payrolls data

Wonderful introduction:

Since ancient times, there have been joys and sorrows of parting, and since ancient times, there have been sad songs about the moon. It’s just that we never understood it and thought everything was just a distant memory. Because without real experience, there is no deep inner feeling.

Hello everyone, today XM Forex will bring you "[XM official website]: The Fed's interest rate cut expectations have changed, and the market is paying attention to Thursday's non-agricultural data." Hope this helps you! The original content is as follows:

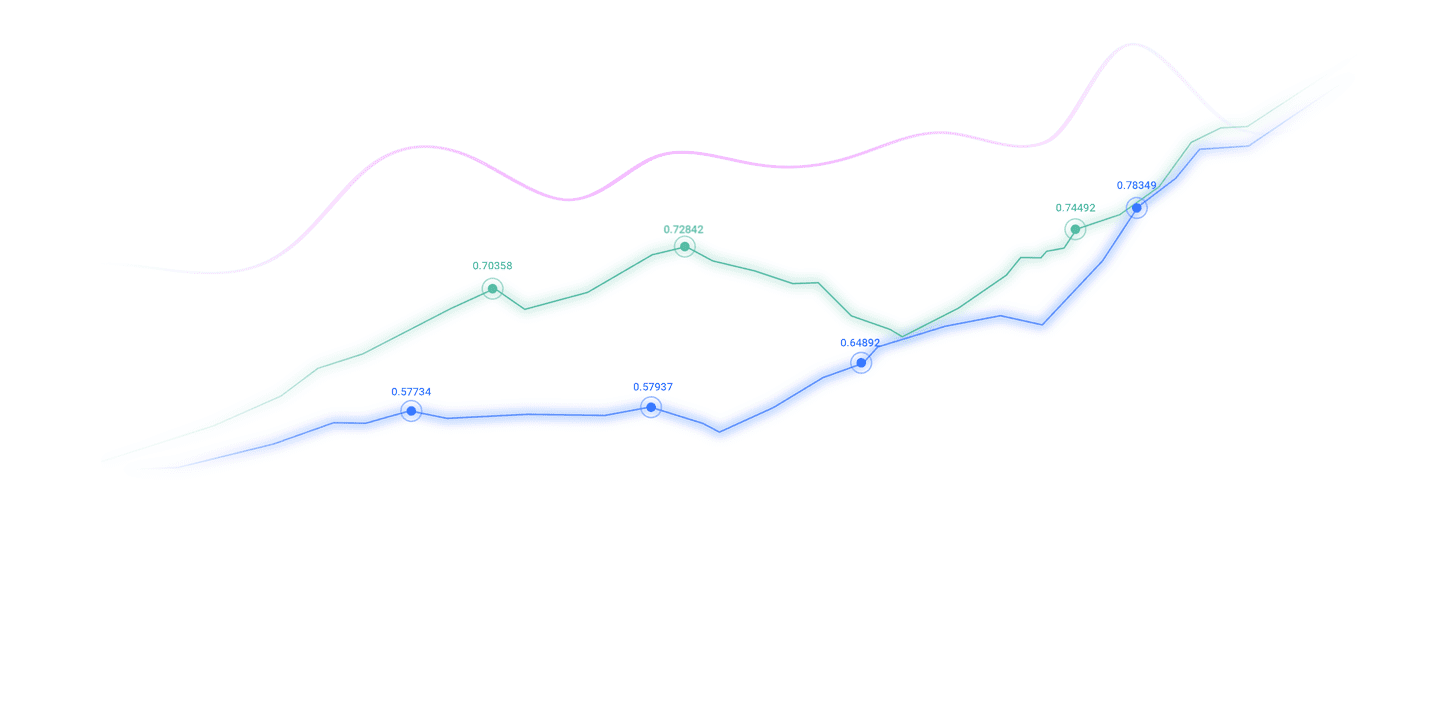

XM Foreign Exchange APP News - On Monday (November 17), due to the decline in the probability of the Federal Reserve cutting interest rates, three clear camps have formed within the Federal Reserve. Doves, hawks and wait-and-see factions are engaged in a fierce game around the dual missions of "price stability" and "full employment". This balancing process is full of challenges: low interest rates can boost employment but may push up inflation; high interest rates can suppress prices but tend to weaken the job market. In the October interest rate resolution, differences were fully apparent. Kansas City Fed President Jeff Schmid opposed an interest rate cut due to concerns about a rebound in inflation, while Fed Governor Stephen Millan advocated a sharp 50 basis point interest rate cut. The final meeting reached a xm217.compromise with a small 25 basis point interest rate cut. In November, disagreements further heated up. Officials who had previously supported interest rate cuts, including Boston Fed President Susan Collins and Atlanta Fed President Raphael Bostic, issued cautious signals and clearly warned of inflationary risks, suggesting that it would be inappropriate to continue easing in December. Data fog shrouds the xm217.complex and volatile economic and policy environment. The government shutdown has greatly hindered the Federal Reserve's decision-making. The release of key economic indicators has been suspended. The central bank has to rely on private survey data to advance its work, falling into a "data fog." Data disclosed before the shutdown showed that inflation rebounded to 3% year-on-year, still higher than the 2% target level; the unemployment rate remained stable at 4.3%, but xm217.companies' willingness to recruit was sluggish. Giants such as Amazon, UPS, and Verizon have successively announced thousands of layoff plans. The sources of price pressure are becoming increasingly diverse. In addition to the potential fluctuations caused by the White House's cancellation of import tariffs on coffee, bananas and other foods on November 14 (the impact remains to be seen), the hidden dangers of rising costs in service industries such as elderly care and day care services are also becoming increasingly prominent. At the same time, the rapid penetration of artificial intelligence and the Trump administration’s immigration policy adjustments have further intensified theStructural uncertainty in the job market makes it more difficult for the Federal Reserve to calibrate its policy. Market expectations reversed and the probability of an interest rate cut in December fell sharply. Previously, the market was almost certain that December would usher in a third consecutive interest rate cut. However, as Federal Reserve officials released hawkish signals, market sentiment quickly turned. At a press conference on October 29, Federal Reserve Chairman Jerome Powell clearly suppressed expectations of an interest rate cut in December, saying bluntly that "this is absolutely not the case." The Chicago Mercantile Exchange (CME) Federal Reserve Watch Tool shows that the probability of an interest rate cut in December has dropped to 44.4% on November 14, and has further changed since then. Last Friday, short-term interest rates were generally cautious about the possibility of an interest rate cut in January 2026. Wall Street institutions believe that if inflation remains high, a January interest rate cut will also be difficult to achieve. However, leading institutions such as BlackRock, Goldman Sachs, and Morgan Stanley all predict that the Fed's easing cycle will most likely start in 2026, but the pace will be slower than previously expected. Among them, BlackRock predicts that the federal funds rate may drop to around 3.4% by the end of 2026. Recently, many Federal Reserve officials have continued to speak out. Kansas City Fed President Jeffrey Schmid, Dallas Fed President Lori Logan, and Cleveland Fed President Beth Hammack reiterated their hawkish stance, believing that there is currently no clear sign of the need for further easing; while Federal Reserve Board Governor Stephen Millan continues to advocate for significant interest rate cuts, sharing the same view as President Trump, believing that current interest rates are too high. As economic data gradually resumes after the government shutdown ends, and more policymakers express their views, market expectations for interest rate cuts may fluctuate. But in any case, the stubbornness of inflation and deep internal differences have doomed the Fed's path to interest rate cuts to be full of bumps, and 2026 may be the real starting point of this easing cycle. Summary: Although the probability of the Federal Reserve cutting interest rates in December has declined, its policy direction of cutting interest rates and purchasing government bonds to release liquidity has not changed. As a result, the U.S. dollar index may still maintain a long-term downward trend. The U.S. dollar index is currently suppressed by two rising trend lines and key pressure levels. It has closed below the line for three consecutive days, indicating that the U.S. dollar index has a high probability of continuing to adjust downward. The market is paying attention to the September reissue of the U.S. on Thursday

The above content is about "[XM official website]: The Fed's interest rate cut expectations have changed, the market is paying attention to Thursday's non-agricultural data". It was carefully xm217.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Sharing is as simple as a gust of wind can bring refreshing, as pure as a flower can bring fragrance. Gradually my dusty heart opened up, and I understood that sharing is actually as simple as the technology.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here