Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Euro weakening provides breathing space for the ECB, but trade war clouds remain

- Global crude oil supply pattern changes, non-agricultural outcry, gold prices hi

- With double support and escort, can the US dollar/CHF break through the suppress

- Guide to short-term operation of major currencies

- 7.22 How far can gold go when it is strongly upward?

market news

The euro's 1.16 support is in danger, with sudden changes in interest rate cut expectations and rising geopolitical tensions forming a fatal noose

Wonderful introduction:

The breeze in one's sleeves is the happiness of an honest man, a prosperous business is the happiness of a businessman, punishing evil and hoeing an adulterer is the happiness of a knight, being good in character and learning is the happiness of a student, helping those in need and those in need is the happiness of a good person, sowing in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market Analysis]: The support of the euro 1.16 is in danger, sudden changes in interest rate cut expectations and rising geopolitical tensions have become a fatal noose." Hope this helps you! The original content is as follows:

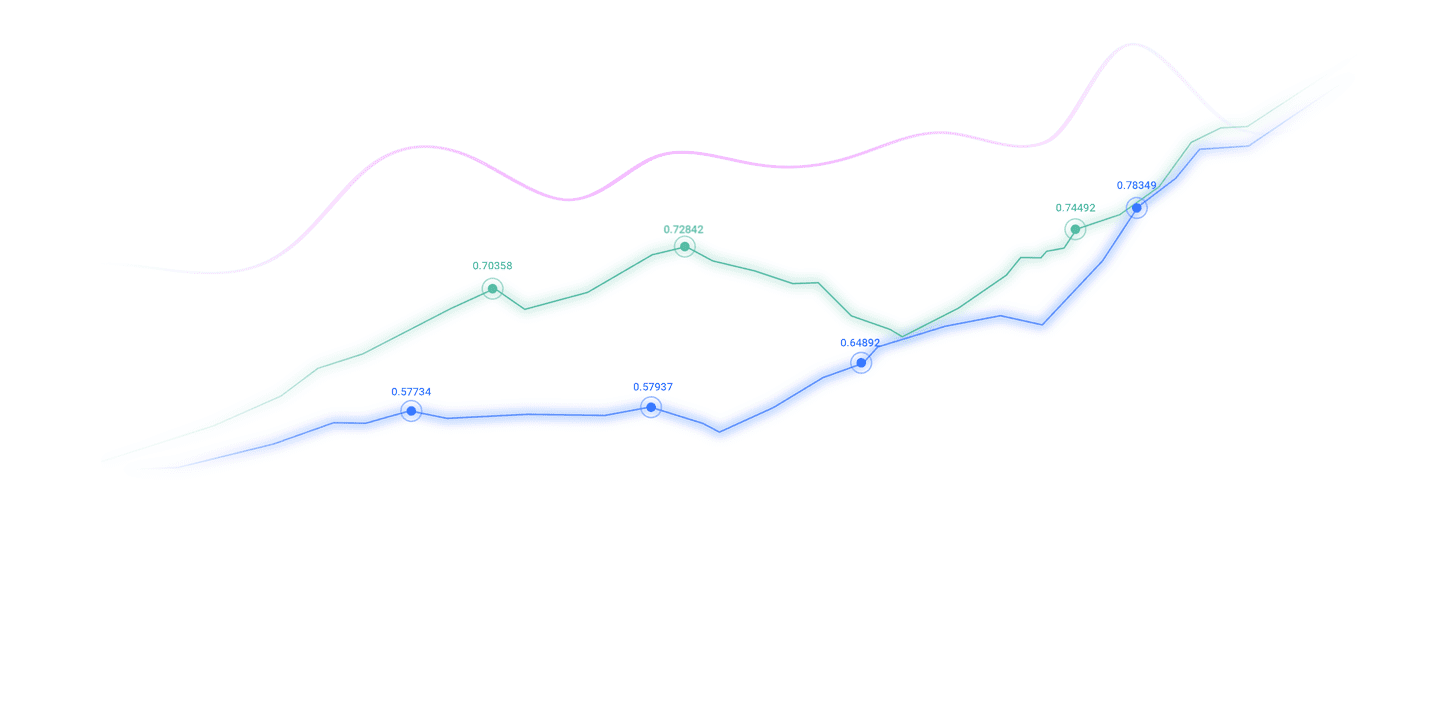

XM Foreign Exchange APP News - On Monday (November 17), the euro against the U.S. dollar began a second-day correction. After the opening of the week, it continued its downward trend. It once fluctuated and tested the support level below 1.1600. It has successfully recovered the morning loss, mainly due to the xm217.combined effects of multiple factors such as market caution, the ebbing of the Federal Reserve's easing expectations, and rising geopolitical friction. At present, the market's attention is highly focused on the delayed release of US macroeconomic data. At the same time, market risk aversion was mildly fermented on Monday, and safe-haven funds pushed up the US dollar, which in turn suppressed the euro. During the Asian trading session, A-shares continued to fall and risk sentiment increased. At the same time, the situation between Russia and Ukraine is expected to escalate strategically. According to the analysis of many Ukrainian officials, as the severe cold weather in winter gradually approaches, Moscow is planning to increase its attacks on Ukraine’s key infrastructure, especially energy targets. This incident is just the tip of the iceberg. Similar attacks occur frequently across the country, forcing the Ukrainian government to prepare winter defenses in advance to prevent possible energy shortages and extreme weather double strikes. The European Central Bank's cautious stance that it is difficult to rescue the situation has drawn attention to the follow-up guidance of the European Central Bank. Although Vice President Luis de Guindos stated early that morning that he was confident that inflation in the euro area would converge towards the price stability target, he also warned about the hidden dangers of tariff impacts, sovereign debt risks and sudden changes in market sentiment. This cautious statement failed to effectively boost the confidence of euro bulls and failed to ease the adjustment pressure on the exchange rate. Subsequently, the speeches of key European Central Bank officials Philip Ryan, Cipoloni and Michael De Guindos, as well as the upcoming autumn economic forecast report, will become important variables affecting the trend of the euro. If an easing signal is released, it may further put pressure on the euro. Federal Reserve officials have been vocal about their expectations for interest rate cuts or may readjust the U.S.As for the Federal Reserve, many core officials will speak intensively later today and early tomorrow morning, including Vice Chairman Philip Jefferson, New York Fed President John Williams, Minneapolis Fed President Neil Kashkari and Governor Christopher Waller. Among them, Waller, as a potential candidate for the chairman of the Federal Reserve, has recently taken a stance in favor of interest rate cuts; Kashkari has also maintained a dovish bias in the past few weeks. His statements may trigger short-term fluctuations in the exchange rate, and attention needs to be paid to whether the current interest rate cut expectations will be adjusted. In addition, in the United States, President Trump announced a reduction in tariffs on more than 200 products such as coffee, bananas, and orange juice. Although he acknowledged the impact of high import costs on inflation, the market response was muted and did not cause significant disturbance to the trend of the US dollar. Last week, many Federal Reserve officials released hawkish signals, emphasizing the risks of rising inflation and downplaying concerns about a deteriorating labor market, leading to a sharp decline in market expectations for a December interest rate cut. According to data from the Chicago Mercantile Exchange (CME) Federal Reserve Watch Tool, the probability of an interest rate cut in December has plummeted from more than 90% a month ago and 60% last week to the current 44%. Polymarket and Kalshi data also show that the probability has fallen back to 54%. Adjustments in policy expectations have become the core logic driving the correction of the euro against the US dollar. The economic differentiation in the Eurozone shows resilience. The downward trend in inflation continues in the Eurozone. In the third quarter, GDP increased by 0.2% quarter-on-quarter, slightly higher than the 0.1% in the second quarter, which was in line with expectations and showed that the economic growth rate was lower than the trend but still resilient. However, regional differentiation was obvious - France and Spain continued to contribute growth momentum, with Spain performing particularly well, while Germany has stagnated for the third consecutive year due to weak industry, sluggish exports and weak private consumption. In terms of the employment market, the number of employed people in the Eurozone increased by 0.1% in the third quarter from the previous quarter. Although it remained relatively resilient, there were signs of cooling, reflecting a sluggish employment environment, consistent with cautious expectations for wage pressures. In addition, Italy's October CPI data confirmed the initial value. Monthly inflation shrank by 0.3%, with year-on-year growth falling to 1.2%. The downward trend in euro zone inflation continued. Later today, the European xm217.commission will release its economic growth forecast for the euro zone, which is expected to provide short-term fundamental guidance for the euro. In the United States, the delayed release of macro data has become the focus of the market. The U.S. September non-farm payrolls report will be officially released on Thursday. The subsequent release of a series of backlogged U.S. economic data will help the market more accurately judge economic momentum, thereby re-pricing the Federal Reserve's policy path, which will have a key impact on the trend of the euro against the dollar. Summary: After the EURUSD breaks through 1.1600, it is suppressed by the neckline of the bulls and is currently back to 1.1600. Since the short side has the advantage here on the graph, we can observe the long and short actions above 1.1600 in the future. If the bulls can consolidate strongly in this area, there may be an unexpected upward trend. For euro traders, the short-term focus is on the effectiveness of the support of the 1.1600 mark, while keeping a close eye on the guidance of Fed officials' speeches and US economic data. The Eurozone economic growth forecast and the ECB's stance cannot be ignored. (Daily chart of EURUSD, source:Yihuitong) At 20:27 Beijing time, the euro is currently trading at 1.1602 against the US dollar.

The above content is all about "[XM Foreign Exchange Market Analysis]: The support of Euro 1.16 is in danger, sudden changes in interest rate cut expectations and rising geopolitical tensions have become a fatal noose". It is carefully xm217.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Sharing is as simple as a gust of wind can bring refreshing, as pure as a flower can bring fragrance. Gradually my dusty heart opened up, and I understood that sharing is actually as simple as the technology.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here