Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Analysis of the latest trends of gold, USD index, yen, euro, pound, Australian d

- The Bank of England has a pigeon in the eagle. What is the warning sign behind t

- The U.S. reached several trade agreements, and the EU is ready for counter-attac

- The "Season 2" of the two parties in the United States begins!

- 8.4 The gold sun closes to determine the universe, and the middle track is stron

market news

The U.S. dollar index rebounded slightly as Fed officials released another strong hawkish signal

Wonderful introduction:

There are always more missed things in life than not missed ones. Everyone has missed countless times. So we don’t have to feel guilty and sad about what we miss, we should be happy about what we have. If you miss beauty, you have health; if you miss health, you have wisdom; if you miss wisdom, you have kindness; if you miss kindness, you have wealth; if you miss wealth, you have xm217.comfort; if you miss xm217.comfort, you have freedom; if you miss freedom, you have personality...

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: The U.S. dollar index rebounded slightly, and Federal Reserve officials released a strong hawkish signal." Hope this helps you! The original content is as follows:

On November 17, in early trading in Asia, spot gold was trading around US$4,102 per ounce. The price of gold was affected by the hawkish remarks of Federal Reserve officials. The probability of the Federal Reserve cutting interest rates in December dropped sharply. However, at the beginning of this week, the geopolitical situation The U.S. Army Secretary said that he was ready to use force against Venezuela; U.S. crude oil was trading around $59.53 per barrel. Affected by geopolitical risks, international oil prices closed sharply higher by more than 2% on Friday. Russia said that Russia and the United States are still in contact regarding the heads of state meeting.

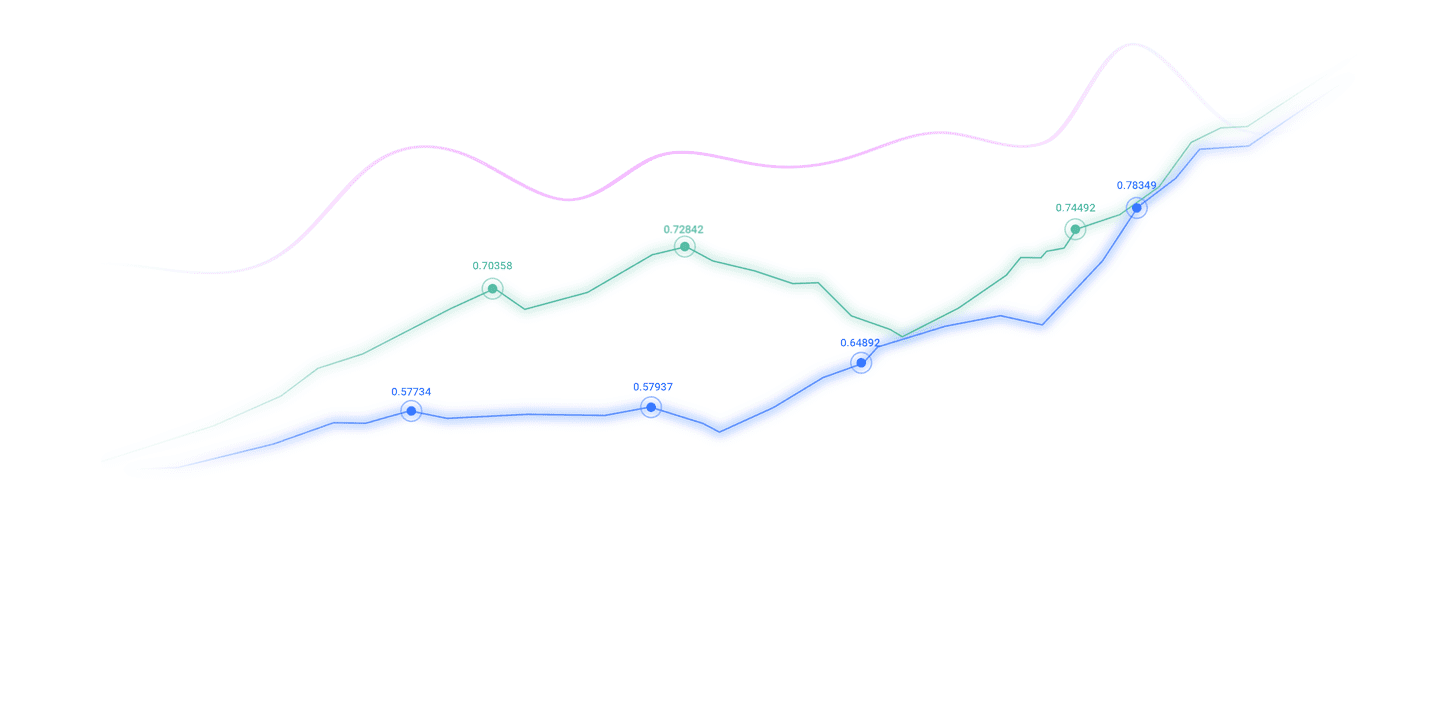

The US dollar showed divergent trends last Friday, rising against the euro but almost flat against the yen. The U.S. dollar index's slight gain was mainly due to the stock market's rebound from a sharp sell-off in early trading, which eased the market's risk aversion sentiment. Meanwhile, traders are reassessing the prospect of a rate cut from the Federal Reserve. Recently, many Federal Reserve officials have expressed concerns about inflation and are cautious about further easing policy, which has led to a sharp cooling of market expectations for an interest rate cut in December. The current federal funds futures market shows that the probability of an interest rate cut is only 41%.

With the end of the U.S. federal government shutdown, a wave of delayed economic data will be released starting this week. The return of these data is expected to end the "data vacuum" of recent weeks and is likely to trigger a rebound in market volatility. Investors are watching the data closely for a clearer signal on the state of the economy and the path of Federal Reserve policy.

Among the major currency pairs, the pound has been particularly weak. Falling sharply against both USD and EUR on mediaReports indicate that the British government has abandoned plans to increase income tax rates, a policy U-turn that has raised concerns about uncertainty about British fiscal policy in the weeks leading up to the budget.

In addition, the Swiss franc strengthened earlier due to safe-haven demand, but USD/CHF ultimately closed higher. A piece of trade news also attracted attention: the United States agreed to significantly reduce tariffs on Swiss goods from 39% to 15% under the new framework agreement.

Asian Markets

Preliminary data released by the Japanese Cabinet Office on Monday showed that the Japanese economy shrank by 0.4% in the third quarter (Q3) of 2025. The reading was above market expectations for a 0.6% decline and the previous forecast for a 0.6% increase (revised from 0.5%).

Japan’s third-quarter gross domestic product (GDP) fell at an annual rate of 1.8%, while the previous value increased by 2.3% (revised from 2.2%), which was stronger than the expected -2.5%.

European market

The euro zone achieved a solid trade surplus of 19.4B euros in September, benefiting from the general growth in merchandise exports. Outbound volume increased by 7.7% year-on-year to 256.6B euros, exceeding the 5.3% year-on-year increase in imports.

The more xm217.comprehensive EU trade balance also returned sharply to a surplus, falling from a -4.5B euro deficit in August to a 16.3B euro surplus in September. The turnaround was mainly driven by a strong rebound in the chemicals sector, whose surplus jumped from €15.4B to €26.9B.

On a partner basis, EU shipments to the United States were the main driver, growing 15.4% year-on-year to €53.1B. Imports from the United States grew solidly at 12.5%, leaving a wider surplus of 22.2B euros. Trade with Switzerland was also strong: exports increased by 13.4% and imports by 10.6%, bringing the bilateral surplus to €6.7B. In contrast, exports to China fell by -2.5% year-on-year, while imports increased by 3.6%, pushing the deficit with China to -€33.1B. Trade flows with the UK were mixed, with exports up 2.8% year-on-year, while imports fell -0.3%, and the surplus widened to €16.1B.

U.S. Market

Logan: It is difficult to support an interest rate cut in December. It is not appropriate to provide more preventive protection to the labor market through interest rate cuts. Director Milan: Data supports interest rate cuts, and the Fed should be more dovish. Schmid: Further interest rate cuts could have a lasting impact on inflation; my concerns about inflation go far beyond tariffs. Market news: Coogler, the former governor of the Federal Reserve, faced an ethics investigation before resigning.

The US-Switzerland trade agreement has basically been reached, and the tariff rate for Switzerland will be 15%.

The release time of some backlogged data in the United States has been determined, and the September non-farm payrolls report will be released on Thursday.

U.S. Office of Government Ethics: Trump purchased at least $82 million in corporate and municipal bonds from the end of August to early October.

Trump said the United States will conduct a nuclear test, according toU.S. Department of Energy officials plan to discourage this.

The above content is all about "[XM Foreign Exchange Market Analysis]: The U.S. dollar index rebounded slightly, and Fed officials released strong hawkish signals again". It was carefully xm217.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Live in the present and don’t waste your present life by missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here