Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Euro/USD enters "event vacuum trial and error period"

- The dollar index is competing for long and short, CPI and Jackson Hall meeting a

- The EU calls on the United States and Russia to restart nuclear strategic dialog

- The US dollar index hovers below 98.00, and trade and the independence of the Fe

- The US dollar hovers below the 98 mark, waiting for US data

market analysis

Gold has strongly broken through 3900, and the short-term range of Europe and the United States has not yet broken.

Wonderful Introduction:

Only by setting off can you reach your ideals and destinations, only by working hard can you achieve brilliant success, and only by sowing can you gain. Only by pursuing can one taste a dignified person.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: Gold has strongly broken through 3900, and the short-term range of Europe and the United States has not broken yet." Hope it will be helpful to you! The original content is as follows:

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed a downward trend last Friday. The price of the US dollar index rose to 97.928 on the day, and fell to 97.569 at the lowest, and finally closed at 97.698. Looking back at the overall market performance last week, the price showed a volatile performance last week. The price continued to rely on the daily support and weekly resistance range, but the overall US dollar index was at a bottoming out, so the price rose after the opening this week, and the bulls continued to continue.

From a multi-cycle analysis, the weekly level has recently been the key consolidation of the weekly line. Currently, the weekly line supports the 97.90 area. We continue to pay attention to the weekly line closing above this position. Once the market closes above this position, we will make a strong rise in the future. From the daily level, as time goes by, the daily line is currently supported in the 97.70 area, and the band above this position of the price has further risen. From a four-hour perspective, the price was under pressure at the four-hour resistance position at the beginning of last week, and the price broke through and rose last Thursday, and then fell back to the daily line and four-hour support on Friday. The overall four-hour support is currently at the 97.80 position. One hour later, the market opened higher today's early trading, and the bulls continued to continue after the price fills the gap.

The US dollar index has a long range of 97.70-80, with a defense of 5 US dollars, and a target of 98.20-98.50

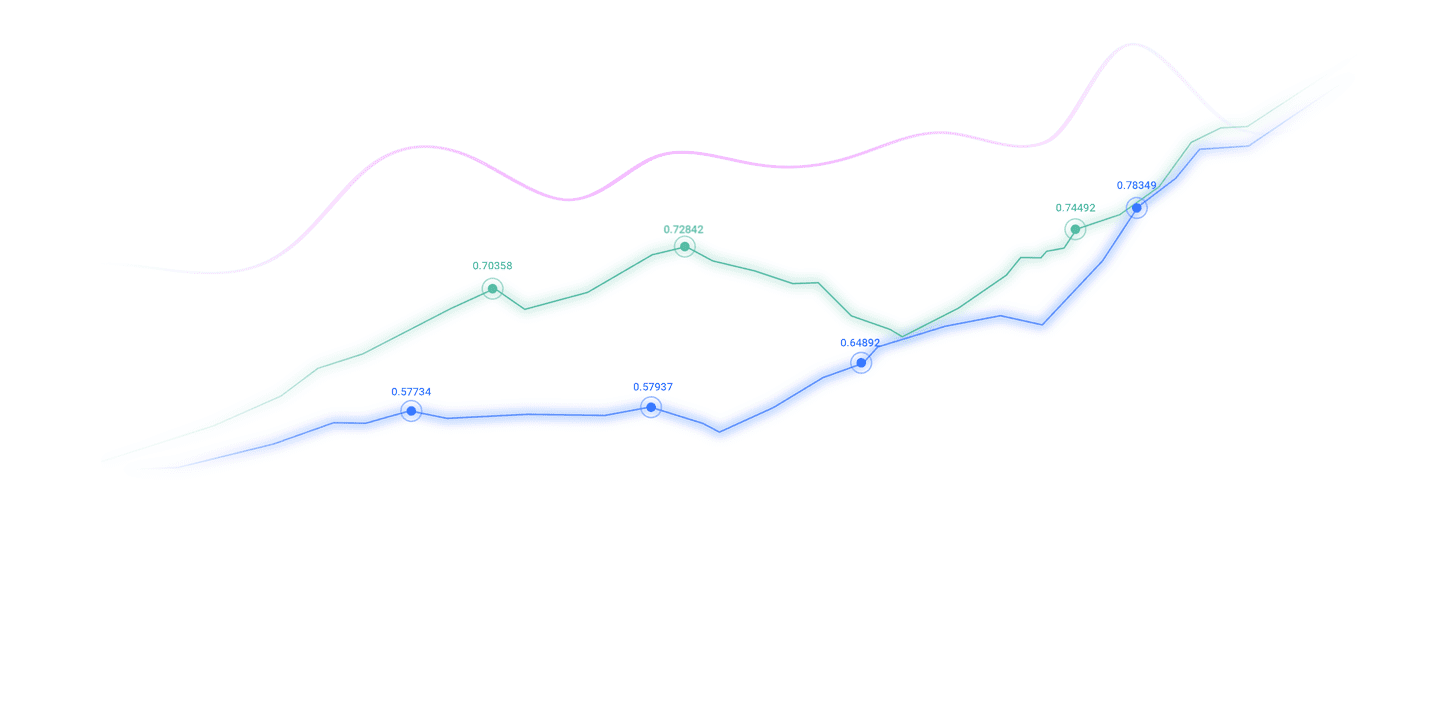

Gold

In terms of gold, the overall price of gold showed an upward trend last Friday, with the highest price rising to 3891.54 on the day, and the lowest fell to 3837.94.Disk at 3885.34. In response to the short-term pressure on gold prices during the early trading session last Friday, the price continued to fluctuate near the four-hour resistance during the European session, and the price broke through and rose again after the session. In the end, both the daily and weekly lines ended with a big positive end, and the bulls continued to continue.

From multi-cycle analysis, first observe the monthly rhythm. From the long-term perspective, the 3130 position is the watershed of the long-term trend. The price can be treated more in the long-term. From the weekly level, the current weekly long and short watershed is at 3531, and the price is above this position and the medium line can be treated more. From the daily level, we need to pay attention to the 3782 regional support for the time being. The band above this position is treated more often, and we will continue to treat the right-hand trading method. From the four-hour perspective, there are two ways to go up the price in the past four-hour period. The first is that when the price is far away from the daily support, the price rises based on the four-hour support. The price breaks down to the four-hour support and does not continue, but continues to rise after breaking down to the four-hour support. Second, when the middle is closer to the daily line, the price rises after testing it to the daily line support. The price was obviously the first case last Friday. Currently, we are temporarily paying attention to the two support 3875 and 3884 in four hours. In one hour, the early trading session will be directly broken through the 3900 position again. At present, the short-term early trading low becomes the key. Radicals maintain long before the early trading low is broken. Conservatives can rely on four-hour support to see the rise.

The early gold low support continues to see bulls continue

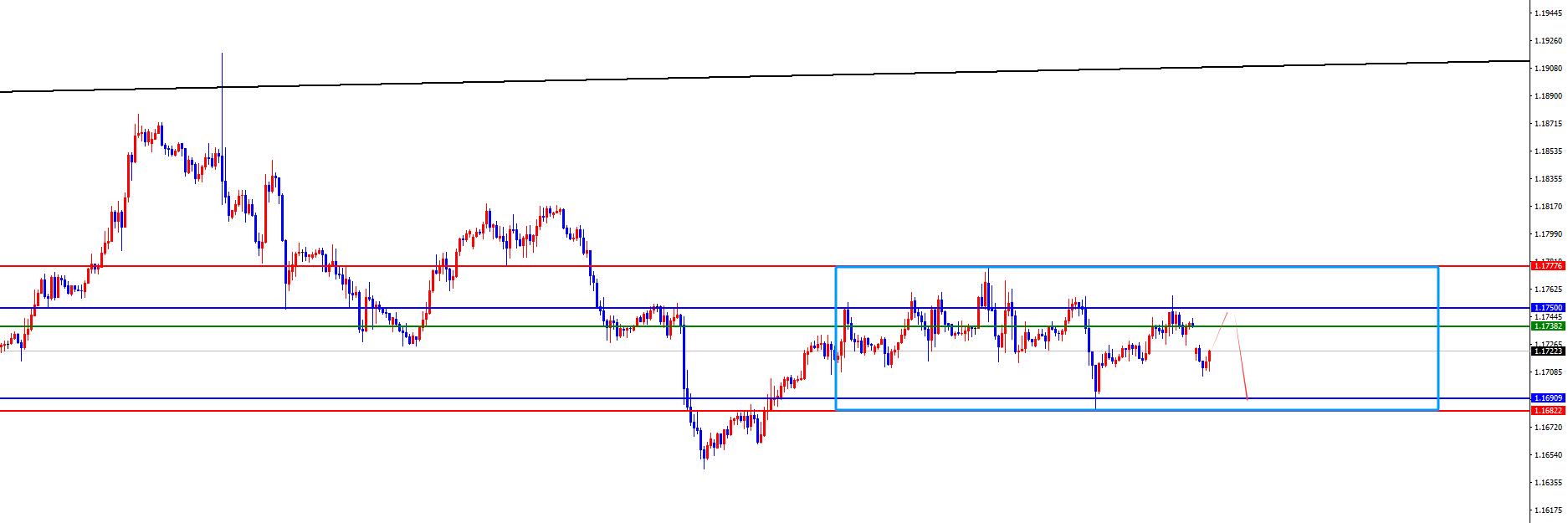

Europe and the United States

In terms of Europe and the United States, prices in Europe and the United States generally showed an upward trend last Friday. The price fell to 1.1712 on the day, and rose to 1.1758 on the highest, closing at 1.1739 on the market. Looking back at the performance of European and American markets last Friday, prices fluctuated and rose during the early trading session. Then, the US market tested to the daily resistance position and was under pressure. From the weekly and daily lines, both positive lines ended, but the current price remained at the 1.1780-1.1680 range, and the subsequent attention will be paid to the continued range after breaking.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.1100, so the price is treated with long-term bulls above this position. From the weekly level, the price is supported by the 1.1690 area. This position is the long-shoulder watershed in the mid-line trend. This week, the key is to focus on whether the weekly closing can close below this position. From the daily level, the daily line is the key to our emphasis on the band trend. Currently, the daily line resistance is at 1.1750, and the price continues to be under pressure below this position. From the four-hour perspective, the price is currently maintaining a fluctuation adjustment in the range of 1.1780-1.1680. Before breaking the upper edge, it is temporarily concerned about the pressure on the upper edge. The price is also fluctuating at the same time, so the operation is temporarily treated as fluctuating. After that, the breaking range will be continued.

Europe and the United States have a range of 1.1740-50, defense is 40 points, target 1.1690-1.1650

[Finance data and events that are focused today] Monday, October 6, 2025

①15:00 Switzerland's September seasonally adjusted unemployment rate

②16:30 Eurozone October Sentix Investor Confidence Index

③17:00 Eurozone August retail sales monthly rate

④22:00 US September global supply chain pressure index

⑤ European Central Bank Governor Lagarde delivered a speech the next day

⑤ p>

⑥Bank of England Governor Bailey delivered a speech at 01:30 the next day

Note: The above is only personal opinions and strategies, for reference and xm217.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and it is not used as a basis for placing an order.

The above content is all about "[XM official website]: Gold has strongly broken through 3900, and the short-term range of Europe and the United States has not broken yet". It was carefully xm217.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thank you for your support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart for a long time. I slipped away~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here