Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar index fluctuates and sorts out on the eve of the Fed Chairman's sp

- Practical foreign exchange strategy on August 7

- The US dollar index is expected to rise, and the Federal Reserve decided to work

- Chinese online live lecture this week's preview

- Renewed differences in trade between Europe and the United States triggered a se

market analysis

The euro lingers on the edge of the cliff! German data has made things worse. Will the US GDP "get another blow"?

Wonderful introduction:

Don't learn to be sad in the years of youth, what xm217.comes and goes cannot withstand the passing time. What I promise you may not be the end of the world. Do you remember that the ice blue that has not been asleep in the night is like the romance swallowed by purple jasmine, but the road is far away and people have not returned, where can the love be lost?

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: The euro is hovering on the edge of the cliff! German data will make it worse, will the US GDP "get another break"?" Hope it will be helpful to you! The original content is as follows:

On Thursday (September 25), the euro stabilized against the US dollar against the US dollar, and fell 0.66% in the previous trading day, as Federal Reserve Chairman Powell rebounded after being cautious about rushing to cut interest rates. The pair is now in a technical consolidation pattern after a significant decline.

The US dollar is boosted by optimistic housing data and the Fed's cautious stance; the euro is under pressure due to weak German confidence and French tax discussions

The current main line of the market has not changed, and the market still expects the Fed to cut interest rates at least twice before the end of the year. But Powell stressed that the Fed will continue to weigh the goals of its dual mission as inflation risks tend to rise and employment risks tend to fall. He pointed out that the current monetary policy is at a "moderately restrictive" level, but it is "positioned well" for future economic development.

Meanwhile, U.S. Census Bureau data showed new home sales rose by more than 20% in August, indicating an improvement in housing market, and the report boosted the dollar's move -- a sell-off on Tuesday as the S&P global PMI was lower than expected.

San Francisco Fed Chairman Daley and Chicago Fed Chairman Goulsby continued their speeches on Wednesday, continuing the intensive voices among Fed officials.

The euro's decline began when Germany's IFO business prosperity index fell to a four-month low in September, indicating a setback in economic recovery. In addition, according to BFM TV, French Prime Minister Le Cornu said he is open to taxing high-income earners and businesses.

The subsequent market will focus on the number of initial unemployment claims, durable goods orders and GDP data that the United States will release for the week ended September 20. There are also several Federal Reserves on Thursday.Officials speak; in the euro zone, Germany's October GfK consumer confidence survey will reflect the latest situation in the family sector.

German IFO business prosperity index data dragged down the euro

U.S. new home sales data in August improved significantly, from 664,000 units to 800,000 units, a 20.5% increase far exceeding the expected 650,000 units.

Federal Gulsbey warned against continuous rate cuts, saying the job market is still basically stable and firm, adding that he disapproved of excessive pre-rate rate cuts based on the presumption that "inflation may only be a temporary phenomenon", and attributed his unwillingness to the policy impact of President Trump.

San Fed Chairman Daley pointed out that further policy adjustments may be needed to achieve price stability and provide necessary support to the job market. She fully supports the Fed's 25 basis points rate cut last week, believing that the economic risk pattern has changed and the time for action is ripe, and stressing that the Fed's interest rate path forecast is not a promise.

The market is closely watching the number of initial unemployment claims in the United States for the week ending September 20, which will be announced on Thursday, and the number of applicants is expected to rise from the previous value of 231,000 to 235,000. The final value of the second quarter GDP annualized quarterly rate released during the same period is expected to remain unchanged at 3.3%.

Durable goods order data in August is expected to improve, following a 2.8% contraction in July. Economists predict that the month-on-month decline will narrow to -0.5%.

Germany's IFO business prosperity index fell from 89 to 87.7 in September, lower than the expected 89.3. The current situation index also fell from 86.4 to 85.7, reflecting the decline in corporate satisfaction with the current operating status. The expected index dropped sharply from 91.6 to 89.7, far lower than the expected value of 92, indicating that the xm217.company's outlook has deteriorated significantly.

According to PrimeMarketTerminal data, the market expects that the probability of the Federal Reserve cutting interest rates by 25 basis points at its meeting on October 19 is more than 90%. On the ECB, given that Governor Lagarde made it clear after the last meeting that "the deflation process has ended", the market generally expects it to keep interest rates unchanged.

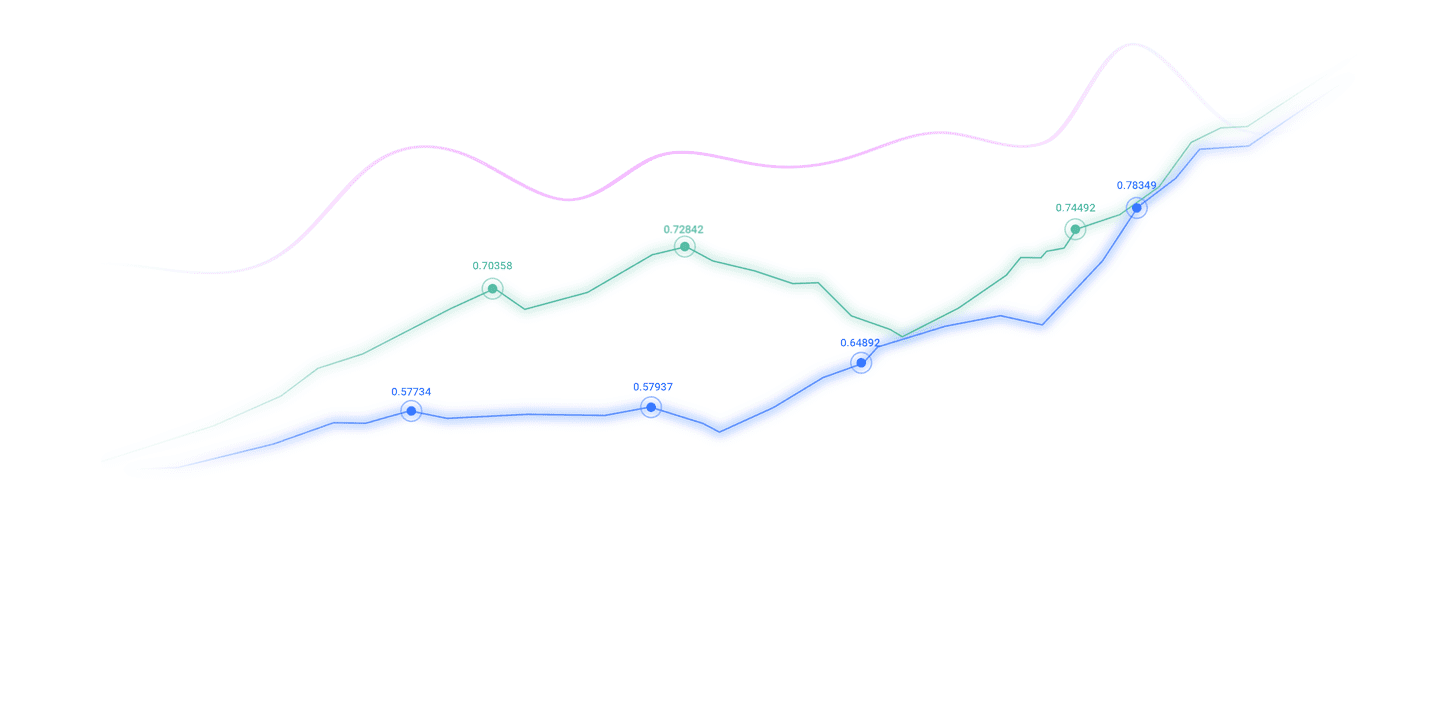

The euro fell below the 1.1800 mark against the US dollar, and the bear target was 1.1700

The overall trend of the euro against the US dollar is still upward, but the daily line forms a "twilight star" pattern, indicating an increase in the probability of a pullback. The closing price of the previous trading day fell below the 1.1750 key position, which may open up space for further downward trends.

The relative strength index RSI is near the midline, indicating insufficient short-term momentum.

In the downward trend, if the exchange rate effectively falls below 1.1700, the initial support level will be 1.1678 where the 50-day simple moving average (SMA), followed by the 1.1560-1.1584 support area where the 100-day moving average converges with the swing low on August 27.

In the upward trend, if the bulls push the price to recover 1.1770, it may rise to the 1.1800 integer mark. The subsequent resistance level is 1.1850, and it may be after the breakthrough.Challenge the year's high of 1.1918.

The above content is about "[XM Foreign Exchange Market Analysis]: The euro is hovering on the edge of the cliff! German data adds to the injury. Will the US GDP "get another knife"?" are carefully xm217.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your transactions! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here