Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

- XM, trading volume hits a new high in the second quarter of 2025, leading the gl

- Silver may test the $37.17 support level

- "Tep Club" finalizes Alaska! White House clarifies gold bar tariffs

- Tep will succeed! Will gold fall below 3300 next week?

market analysis

The U.S. GDP rose sharply in the second quarter! US dollar index hits new highs in the past two weeks

Wonderful introduction:

Don't learn to be sad in the years of youth, what xm217.comes and goes cannot withstand the passing time. What I promise you may not be the end of the world. Do you remember that the ice blue that has not been asleep in the night is like the romance swallowed by purple jasmine, but the road is far away and people have not returned, where can the love be lost?

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: The US GDP rose sharply in the second quarter! The US index hit a new high in the past two weeks." Hope it will be helpful to you! The original content is as follows:

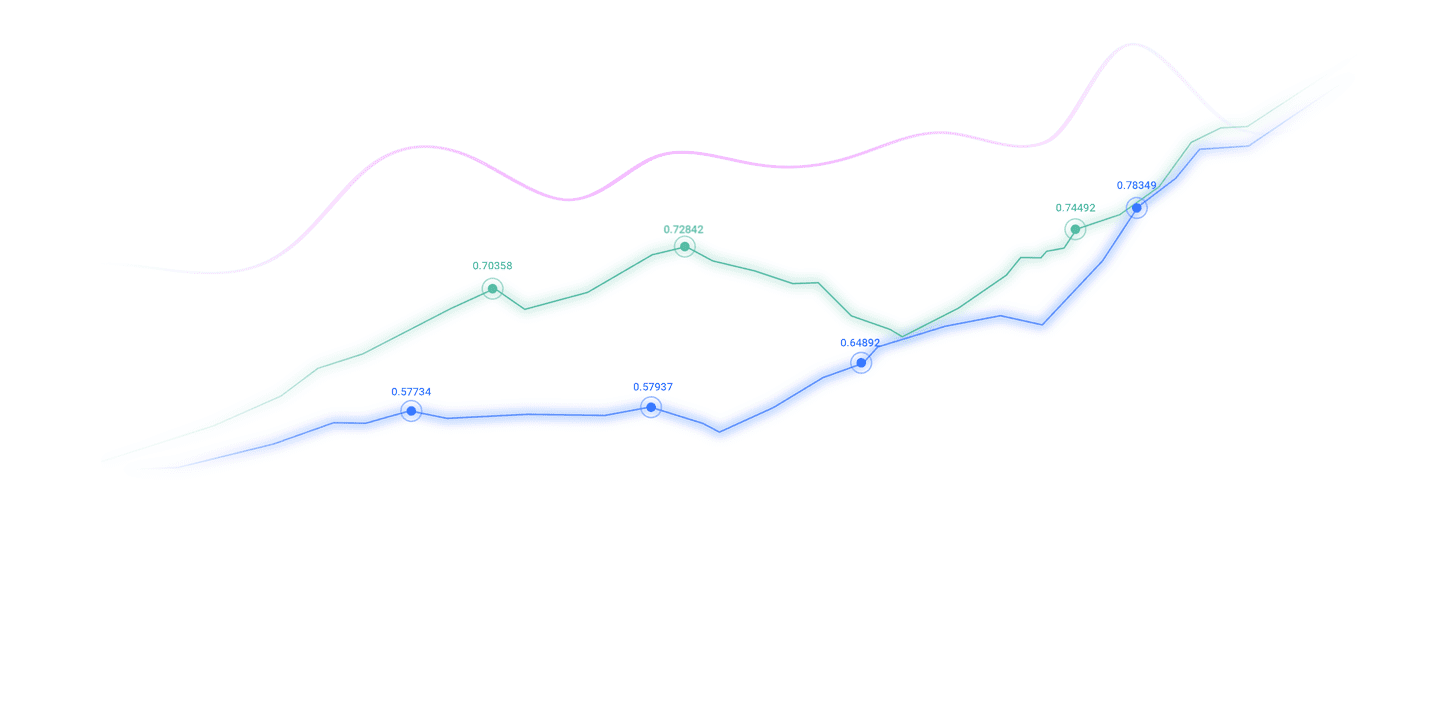

On September 26, in the early trading of Asian market on Friday, Beijing time, the US dollar index hovered at 98.47. On Friday, the US dollar index rose sharply before the U.S. session and hit a new high in the past two weeks, finally closing up 0.58% to 98.45. The benchmark 10-year U.S. Treasury yield closed at 4.168%, while the 2-year U.S. Treasury yield closed at 3.655%. Spot gold fell into volatility, and the $3760 mark was measured several times during the session, but none of them could stand firm. It finally closed up 0.35%, closing at $37,449.05/ounce; spot silver rose sharply, standing above $45, continuing to hit a new high since May 2011, and finally closed up 2.9%, at $45.17/ounce. Crude oil fell first and then rose. WTI crude oil quickly recovered all lost ground during the US session and rushed to the $65 mark, finally closing up 0.56% to $65.00/barrel; Brent crude oil finally closed up 0.58% to $68.72/barrel.

Analysis of major currencies trends

Dollar Index: As of press time, the US dollar hovered around 98.47. The dollar has risen slightly since the Fed cut interest rates as expected last Monday. Although statements from policymakers, including Chairman Powell, suggest that rate cuts will largely depend on upcoming economic data, traders still expect rates to be cuts in the remaining two Fed meetings this year. Technically, the U.S. dollar index is trying to close above resistance at 98.00–98.20. If this attempt is successful, the U.S. dollar index will move to the next resistance level, which is in the 98.85–99.00 range.

Analysis of gold and crude oil market trends

1) Analysis of gold market trends

On Friday, gold hovered around 3749.65. Gold is standing at a delicate crossroads as markets focus on the Fed's interest rate cut path. On the one hand, strong economic data and the rising dollar are constantly questioning the necessity of loose policies; on the other hand, there is the geopolitical and the ready-to-go buying on dips, building a solid bottom for gold prices. A long-short war dominated by key inflation reports is about to break out. In addition, investors need to continue to pay attention to the speeches of other Federal Reserve officials and the news about the geopolitical situation.

2) Analysis of crude oil market trends

On Friday, crude oil trading was around 64.98. Oil prices stabilized on Thursday after hitting a seven-week high on the previous trading day, with Russia announcing it would limit fuel exports to the end of the year, but strong U.S. economic data weakened market optimism for further rate cuts, thus limiting oil price gains. In addition, bearish expectations of supply fundamentals also put pressure on oil prices, and the market expects crude oil supply to Iraq and Kurdistan to increase. The Kurdish Autonomous Region Government announced on Thursday that oil exports will resume within 48 hours.

Forex market trading reminder on September 26, 2025

①20:30 Canada's July GDP monthly rate

②20:30 US August core PCE price index annual rate

③20:30 US August personal expenditure monthly rate

④20:30 US August core PCE price index monthly rate

⑤21:00 US Federal Reserve Barkin delivered a speech

⑥22:00 US September Michigan Consumer Confidence Index final value

p>

⑦22:00 The expected final value of the US one-year inflation rate in September

⑧22:00 Federal Reserve Director Bowman delivered a speech

⑨The next day 01:00 the total number of oil drilling rigs in the week from the United States to September 26

⑩The next day 01:00 the Federal Reserve Director Bowman attended the dialogue

The above content is about "[XM Foreign Exchange]: The US GDP increased significantly in the second quarter! The US index hit a new high in the past two weeks". It was carefully xm217.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your transactions! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here