Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

location: Home > News > market analysis

market analysis

market analysis2025-11-14

The total prize pool of the Global Agent Rising Star Competition is $150,000

XM announced the official launch of a new agent welfare activity - the XM Global Agent Rising Star Competition. 30 winners around the world will have the opportunity to share a total prize pool of up to $150,000. During the event period from November 17, 2025 ...

market analysis2025-11-14

Silver surges to $54.41, setting new record

XM Exchange Review: Silver surged to $54.41, setting a new historical record Yesterday, COMEX silver opened at US$53.27 and rose to US$54.41 during the session, surpassing the highest point of US$53.76 on October 17 and setting a new record. The highest point ...

market analysis2025-11-14

Hong Kong stocks retreated after four consecutive days of gains, and the 26,000

XM: Hong Kong stocks retreated after four consecutive days of gains, and the 26,000 mark may once again play an important role as support. The Hang Seng Index closed at 26,732 points at noon, down 340 points. The H-Share Index fell 132 points, or 1.4%, to 9,46...

market analysis2025-11-14

Gold still pays attention to pressure

The U.S. government finally reopened its doors after a 43-day shutdown, and then the market ushered in a wave of intense "turbulence." The three major U.S. stock indexes fell, the U.S. dollar plummeted, U.S. bond yields rose, the crypto market fell, gold and s...

market analysis2025-11-14

Gold, the rising pattern has not changed!

At present, the overall rising pattern of gold has not changed, and there is no deterministic top structure. Therefore, the sharp decline after the high of 4250 last night is still regarded as an adjustment. In other words, the downward adjustment in the upwar...

market analysis2025-11-14

The U.S. dollar index continues to fall as the U.S. government reopens

On November 14, in early trading in Asia, spot gold was trading around US$4,180 per ounce. The price of gold fell back on Wednesday after hitting a three-week high of US$4,244.96 per ounce, giving up the early gains that may have boosted expectations for an in...

market analysis2025-11-14

Golden Wulianyang station reaches 4200! Interest rate cut expectations set off t

On Thursday (November 13), spot gold rose for the fifth consecutive trading day, with a current cumulative increase of about 5.5%, and the price of gold stood at US$4,200 per ounce. Buying pressure has remained firm recently, supported by expectations that the...

market analysis2025-11-14

A lose-lose game, the shutdown is a theater rather than a policy tool

On October 1, 2025, the U.S. federal government fell into the longest 43-day shutdown in history due to the deadlock between the two parties over the renewal of subsidies for the Affordable Care Act (ACA, also known as Obamacare). The Democrats insist on linki...

market analysis2025-11-14

The supply flood has arrived, why does palm oil refuse to fall deeply?

On Thursday (November 13), despite facing the dual pressure of rising production and weakening demand in India, Malaysian palm oil futures still ended up slightly higher today. As of the close, the main January contract on Bursa Malaysia Derivatives Exchange c...

market analysis2025-11-14

Short-term weakness masks long-term supply challenges

OPEC‘s latest monthly report adjusted its supply and demand forecast for the third quarter from a deficit of 400,000 barrels per day to a surplus of 500,000 barrels per day. In addition, other institutions predict that the surplus will expand in 2026. The mark...

market analysis2025-11-14

The US government "shutdown" crisis is just a pause! Gold’s safe-haven charm rem

In the first half of the European session on Thursday (November 13), spot gold continued its upward trend for the third consecutive trading day and climbed to a three-week high. Investors generally believe that due to the long-term shutdown of the U.S. governm...

market analysis2025-11-14

Gold surged higher and fell back on 11.14, and the Asian trading range consolida

Your profits come from other people‘s losses. In other words, when someone makes a mistake, profits will appear in the market that can be earned, but you cannot calculate or predict how many people will make a mistake next, or how big of a mistake they will ma...

market analysis2025-11-14

The U.S. government ends its longest shutdown, and the Fed’s hawkish signal supp

On November 14, in early trading in Asia on Friday, Beijing time, the U.S. dollar index was hovering around 99.24. On Thursday, as the U.S. government reopened, the U.S. dollar index continued to decline and once fell below the 99 mark, finally closing down 0....

market analysis2025-11-14

Analysis of the latest market trends of 11.14 gold, which encountered resistance

The ups and downs of the investment market are sometimes traceable, and sometimes unreasonable. The criterion for deciding whether to participate in the market is whether you can find sufficient reasons to convince yourself through your own trading system. The...

market analysis2025-11-14

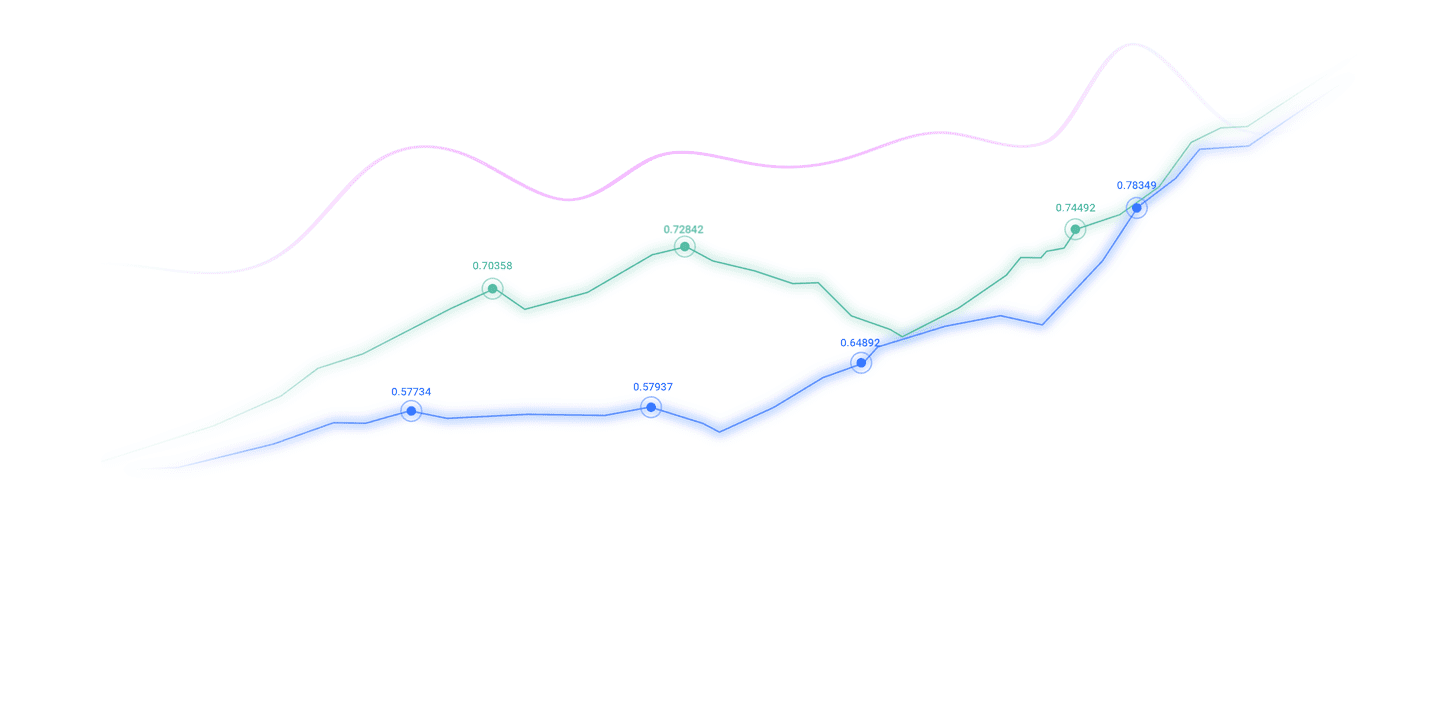

Short-term operation guide for major currencies

From a technical point of view, the U.S. dollar index‘s rise on Thursday was blocked below 99.60, and its decline was supported above 98.95, which means that the U.S. dollar is likely to maintain a downward trend after a short-term rise. If the U.S. index‘s ri...

CATEGORIES

News

- A collection of positive and negative news that affects the foreign exchange mar

- Hang Seng Index lacks motivation to challenge 25,000, pay attention to the perfo

- The dollar index is competing for long and short, CPI and Jackson Hall meeting a

- 7.22 How far can gold go when it is strongly upward?

- Be careful of falling back when gold is short-term, and the current price of 338

- Unexpected performance of Japan's GDP intensifies the Bank of Japan's interest r